Understanding Revenue Constraints Under ASC 606 and IFRS 15

Revenue recognition under ASC 606 and IFRS 15 is fundamentally driven by the transfer of control of goods or services to a customer. However, in certain business scenarios, transfer of control alone is not sufficient to recognize revenue. In such cases, organizations apply additional satisfaction conditions, one of the most common being payment.

This concept is rooted in the standards’ requirement to ensure that recognized revenue reflects the amount an entity expects to be entitled to, considering collectability and contractual constraints.

Why Would Payment Be an Additional Condition?

Both ASC 606 and IFRS 15 introduce the concept of revenue constraints, particularly when there is uncertainty around collectability or entitlement. Even if a performance obligation has been delivered, revenue may be limited or deferred until payment-related conditions are met.

Typical business scenarios include:

1. High Credit Risk Customers

When a customer’s ability or intention to pay is uncertain, organizations may require cash collection before recognizing revenue, even if the service or product has been delivered.

2. Non-Refundable Upfront Fees

Certain upfront fees are recognized only after payment is received, as payment confirms entitlement and reduces uncertainty.

3. Regulatory or Contractual Requirements

In regulated industries or government contracts, revenue recognition may be contractually or legally permitted only upon receipt of payment.

4. “Pay-to-Recognize” Contract Clauses

Some contracts explicitly state that revenue is earned only once payment milestones are met, regardless of delivery status.

In all these cases, payment acts as a gating condition for revenue recognition.

Relationship to Performance Obligations

Under the standards, revenue is recognized when a performance obligation is satisfied. However, satisfaction may be subject to additional conditions beyond delivery, such as payment.

This does not replace the primary satisfaction assessment (point in time or over time), but rather limits or constrains the amount of revenue that can be recognized at any given time.

How Revenue Is Typically Calculated When Payment Applies

When payment is used as an additional satisfaction condition, revenue is often recognized proportionally based on how much consideration has been received relative to the total contract value.

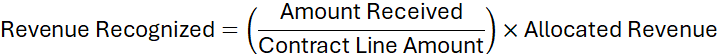

A commonly applied proportional formula is:

Explanation of Components:

- Contract Line Amount: Total contractual consideration for the good or service

- Allocated Revenue: Revenue allocated to the performance obligation

- Amount Received: Payment collected to date

Example

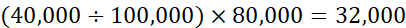

Contract Details:

- Contract Line Amount: $100,000

- Allocated Revenue: $80,000

- Payment Received to Date: $40,000

Revenue Recognized:

Result:

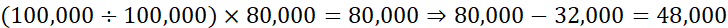

- Revenue recognized to date: $32,000

- Remaining deferred revenue: $48,000

Even if the service has been fully delivered, revenue recognition remains constrained by payment progress.

Key Accounting Rationale

Applying payment as an additional satisfaction condition ensures:

- Revenue is not overstated

- Recognized revenue reflects entitlement and collectability

- Financial statements comply with the constraint guidance in ASC 606 and IFRS 15

This approach reinforces the standards’ principle that revenue should depict the transfer of goods or services in an amount the entity expects to be entitled to.

Journal Entry Illustrations

To better understand how payment-based constraints impact accounting, let’s walk through typical journal entries across the lifecycle of a contract.

Key Principle Reminder

Under ASC 606 / IFRS 15:

- Billing creates a contract asset or contract liability

- Revenue is recognized only when the performance obligation is satisfied and constraints (such as payment) are met

- Deferred revenue (contract liability) represents billed but unsatisfied (or constrained) performance obligations

Assumptions (Same as Earlier Example)

- Contract Line Amount: $100,000

- Allocated Revenue to Performance Obligation: $80,000

- Revenue constrained by payment

- Payment received to date: $40,000

- Revenue eligible to be recognized: $32,000

1. At Contract Inception (No Billing, No Payment)

At contract inception, no revenue is recognized because:

- Performance obligation may not yet be satisfied, or

- Payment constraint applies

No journal entry is recorded

(Contract exists, but no accounting impact yet)

A single billing event has two-step accounting impact, where AR accounting and Revenue accounting each create their own entries, resulting in a reclassification between Deferred Revenue and Contract Assets.

The Two-Sided Accounting for a Billing Event

(Deferred Revenue and Contract Asset Both Impacted)

Under ASC 606 / IFRS 15, billing, payment, and revenue recognition are independent processes. A single billing event can generate multiple accounting entries across subledgers to properly reflect contractual rights and obligations.

STEP 2.1: Billing Event – Accounts Receivable Accounting

The first accounting entry is generated from the Accounts Receivable perspective, reflecting that the customer has been billed, but revenue is not yet earned.

Journal Entry (AR Perspective)

- Dr Accounts Receivable …… $40,000

- Cr Deferred Revenue …… $40,000

Accounting Meaning

- The entity has a right to invoice

- The entity also has an obligation to deliver goods/services

- Deferred Revenue represents a contract liability

At this stage:

- No revenue is recognized

- No contract asset exists yet

STEP 2.2: Same Billing Event – Revenue Accounting Reclassification

From a revenue accounting perspective, the same billing event must be evaluated against performance obligations. Because the performance obligation is not yet satisfied (or constrained), the billed amount is reclassified.

Journal Entry (Revenue Perspective)

- Dr Deferred Revenue …… $40,000

- Cr Contract Asset …… $40,000

Accounting Meaning

- Deferred Revenue is cleared from a billing-only liability

- Contract Asset represents a conditional right to consideration

- The right is conditional because satisfaction (or payment constraint) is still pending

This step is critical to align billing balances with revenue recognition logic.

3. Upon Receipt of Payment

Payment removes the collectability constraint but does not automatically trigger revenue unless performance conditions are met.

Journal Entry:

- Dr Cash …… $40,000

- Cr Accounts Receivable …… $40,000

No revenue is recognized yet at this step.

4. Revenue Recognition Based on Payment Constraint

Once the performance obligation is satisfied and the payment constraint allows recognition: Revenue is recognized only to the extent payment allows.

Revenue Recognized:

Journal Entry:

- Dr Contract Liability …… $32,000

- Cr Revenue …… $32,000

This entry reflects revenue recognized in proportion to payment received.

5. Remaining Deferred Revenue Balance

After recognizing $32,000:

- Contract Liability balance remains $48,000

- This balance will be recognized as additional payments are received

6. Subsequent Billing, Payment, and Final Recognition

When remaining amounts are billed and collected, the same pattern applies:

- AR billing → Deferred Revenue

- Revenue accounting → Deferred Revenue → Contract Asset

- Revenue recognized → Contract Asset → Revenue

Until the performance obligation is fully satisfied and constraints are removed.

Key Conceptual Summary

| Item | Represents |

| Deferred Revenue | Billing-based contract liability |

| Contract Asset | Conditional right to consideration |

| Revenue | Earned and recognized consideration |

Billing creates obligations.

Revenue accounting aligns those obligations to performance obligations.

Revenue recognition clears contract assets.

If an additional $60,000 is received later:

Revenue Eligible:

Journal Entries:

a) Payment Receipt

- Dr Cash …… $60,000

- Cr Accounts Receivable …… $60,000

b) Revenue Recognition

- Dr Contract Liability …… $48,000

- Cr Revenue …… $48,000

At this point, the performance obligation is fully satisfied, and all allocated revenue has been recognized.

Why This Separation Is Important

- Prevents premature revenue recognition

- Ensures contract balances are correctly classified

- Aligns AR, Revenue, and GL under ASC 606 / IFRS 15

Key Takeaways for Accounting and Audit

- Billing ≠ Revenue

- Payment may cap revenue recognition

- Revenue is recognized only to the extent the entity is entitled

- Contract liabilities represent unsatisfied or constrained performance obligations

This treatment ensures compliance with the constraint guidance under ASC 606 and IFRS 15 and prevents premature revenue recognition.

Final Thoughts

While delivery and control transfer remain central to revenue recognition, payment-based constraints play a critical role in scenarios involving credit risk, contractual restrictions, or regulatory requirements. Understanding when and how to apply these constraints is essential for accurate, compliant revenue reporting under ASC 606 and IFRS 15.