- The cost of capital is the cost a company incurs for raising funds to finance its operations and investments.

- It represents the required rate of return that investors expect to receive on their investment in the company’s equity and debt securities.

- It’s the opportunity cost of using funds in a particular investment or project, taking into account the risk associated with that investment.

- The cost of capital is a critical concept in corporate finance and investment analysis because it is used to evaluate the feasibility of investment projects, make capital budgeting decisions, and determine the appropriate capital structure for a company.

There are two main components of the cost of capital:

- Cost of Debt: This refers to the cost a company incurs for raising funds through debt financing, such as issuing bonds or taking out loans.

- The cost of debt is typically represented by the interest rate the company pays on its debt securities.

- Cost of Equity: This represents the return that investors require on their investment in the company’s equity securities, such as common stock.

- The cost of equity is influenced by factors such as the company’s perceived riskiness, the expected return on the market, and the company’s dividend policy.

In addition to debt and equity, some companies may also have other sources of financing, such as preferred stock or hybrid securities. The cost of capital takes into account the weighted average cost of all these sources of financing, where each component is weighted by its proportion in the company’s capital structure.

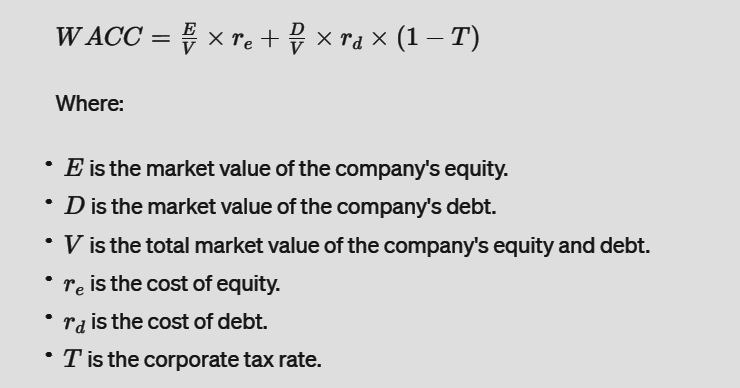

The formula to calculate the weighted average cost of capital (WACC), which represents the overall cost of capital for a company, is:

The cost of capital is a crucial input in financial decision-making and is used as a discount rate in discounted cash flow (DCF) analysis, capital budgeting, and valuation models to assess the attractiveness of investment opportunities and estimate the value of a company or its projects.